Summary

As the life sciences industry continues to grow, there is an emergent trend toward the need for a real-time, automated, and integrated supply chain based on the concept of a Smart Inventory Management System. The life sciences industry is burdened with many manual and outdated processes that create difficulties for staff and company operations. It is important to determine proactive, value-based solutions that create significant changes in workflows and efficiencies. To better understand what is driving the need for change within the life sciences industry, it is helpful to first define the key issues.

Key Issues Affecting the Life Sciences Industry

- Manual processes inundate workflows and create errors, hurt customer relationships, drive up costs, and ultimately create burdened environments for employees.

- Temperature monitoring of items in storage and during transportation is needed to ensure product integrity and facilitate regulatory compliance.

- Many organizations are looking for an e-commerce experience that enables them to purchase scientific products online.

- An integrated supply chain, in which all key players (i.e. labs, manufacturers, and distributors) can share real-time information, is necessary to the entire value chain.

- Real-time visibility is becoming more necessary for quick, accurate, and efficient inventory availability and usage data.

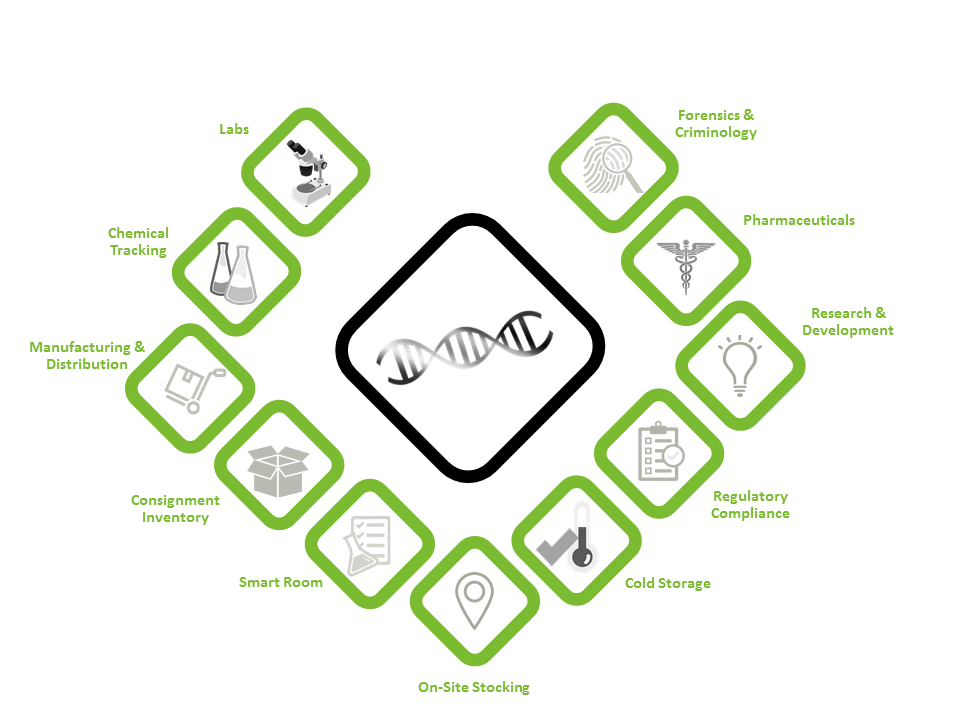

Terso defines “life science” as any company in the fields of biotechnology, pharmaceuticals, biomedical technologies, life systems technologies, nutraceuticals, cosmeceuticals, food processing, environmental, biomedical devices, and organizations and institutions that devote a majority of their efforts in research, development, technology, and commercialization.

Labs continue to struggle with limited funds, cost pressures, economic uncertainty, demand for value-based outcomes, and a changing regulatory environment. Since 2004, the National Institutes of Health funding to labs has decreased by more than 20 percent. To cope with shrinking funds and growing cost pressures, labs have tightened their budgets and are focused on keeping costs down. “Most laboratories are significantly concerned about cost reductions,” according to Frost & Sullivan’s Mid-Year 2017 LPA End User Trends Survey.