Introduction

As of 2018, the medical device market has grown to a $423.8 billion dollar industry and is expected to grow to $521.64 billion by 2022. With over 6,500 medical device companies and a growing amount of inventory being transported in the field on a daily basis, gaining real-time visibility of inventory is necessary. Mounting regulatory standards, demand, costs, and inefficiencies are all driving the industry toward a much-needed change for inventory management, specifically field inventory.

While many solutions exist for managing critical supplies, a fully connected, smart inventory management system presents the most proactive solution for automating inventory management. Connecting assets using IoT technology enables medical device manufacturers and hospitals alike real-time information throughout the supply chain, thus better meeting customer demands, improving patient safety, meeting regulatory compliance standards, and accurately monitoring temperature and expiration dates. All resulting in a much better outcome for suppliers and providers.

The Current Inventory Landscape Is Not Sustainable

The term “medical devices” covers a wide variety of items, from a simple pair of sutures or a wheelchair to pacemakers and vascular grafts. All of which are essential to providing uncompromised patient care for healthcare organizations across the U.S. Be it a small rural clinic or a nine-hundred-bed hospital, medical devices are a major part of the healthcare industry. The U.S. Department of Commerce estimates that the US medical device market has grown to $423.8 billion. Currently, there are over 6,500 medical device companies that supply innovative products and services to over 6,000 healthcare provider locations in the U.S. Through the growth and evolution of this significant market over the past 50 years, the importance of having the right instrument or implant at the right place at the right time is increasingly critical. Unlike the retail sector where a stock-out usually means a lost or delayed sale, a stock-out within the health industry results in a much worse outcome, and must be avoided at all costs, as this puts patient safety at risk and seriously jeopardizes the relationship between the healthcare provider and supplier.

To prevent this, medical device manufacturers have developed numerous, often complex, supply chain and distribution models. These traditional models often rely on the sales representative or inventory specialist delivering the product to the hospital on the final mile of its journey. The result of this intricate network to get a product to the right place at the right time results in a continuous buildup of inventory in the field.

Field inventory represents the process of inventory from the point of manufacture or main distribution center to the point-of-use. Too often, field inventory ends up in forward stocking locations (i.e. trunks, homes, on consignment at hospitals, or in-transit between any one of those locations). In some cases field inventory is cycled quickly, arriving to the final destination via a sales representative for a specific procedure then sent back to a central distribution center immediately after. In other cases an implant can sit as consigned inventory at a hospital for years.

To date, the challenge for field inventory management has been visibility. In the majority of instances, once product leaves the manufacturing facility or main distribution center its location and status can only be determined by manual efforts.

Traditionally this involves customer service calls to a sales representative inquiring about a particular piece of inventory. Rather than view inventory in real-time as it moves through the supply chain, medical device companies scramble to avoid stock-outs and reconcile actual demand from current inventory, while also ensuring they are in compliance with increasing regulations.

An independent healthcare industry consultant recently studied the inventory patterns of 49 publicly traded manufacturers of medical devices and instrument products. The median number of days in inventory was 137, meaning that a great deal of high-valued inventory is floating out in the field for half a year or more on average. At a time when there is increasing pressure on margins and efficiencies, the glut of inventory in the field emphasizes the problem. The highest number was 400 days, meaning that the manufacturer has more than one year of inventory out in the field, a likely red flag for financial auditors and investors alike. Not to mention, this increases the threat of expired product circulating in the field with the potential to be used in a procedure.

If a company with $1 billion in sales cannot account for nearly half of its field inventory, auditors will want proof that the inventory is real and will likely require monthly sales audits, resulting in additional time and expenses.

The old adage “if it’s not broken, don’t fix it” has applied to the medical device industry for years. However, the research and current landscape show that the way inventory is managed is, in fact, broken. Approaching this problem in a proactive way is the best solution to a market that has continued to operate in a manual, reactive manner. The growing levels of field inventory has created serious challenges for stakeholders in the healthcare community, including:

Financial

Medical device companies are required to report inventory as an asset on their balance sheet and, in turn, tie up cash in inventory. This negatively impacts cash flow and invites auditors to require the company to verify inventory levels on a more regular basis. The Sarbanes-Oxley Act, enacted in 2002, requires U.S. companies to substantiate that inventory is real. Without knowing where inventory is in real-time, it becomes nearly impossible to meet these requirements.

Expiration Date Management

Expiration of inventory causes many serious risks and challenges for healthcare organizations. Without item-level traceability, a hospital has no real access to expired products until a manual reconciliation is performed. Even so, many products are still unaccounted for on a monthly basis and with growing in-field inventory levels, it becomes unmanageable to track distributed expired inventory.

Product Integrity & Temperature Monitoring

Numerous medical devices and suppliers have temperature storage requirements to ensure their integrity. Without real-time visibility to inventory in the field, it is virtually impossible to ensure that these products have been stored in their required temperature range.

Counterfeit Product

The more product that is kept in the field, the more chance there is for counterfeit or compromised product. There is an abundance of inventory kept with a field representative at any given time, plus large warehouses are storing hundreds or thousands of products at a time, often for years on end. Rather than store bulk amounts of inventory in a few locations, it is better for product integrity to distribute in regional locations for shorter periods of time. This not only heightens the integrity of a product, but allows inventory to be readily available for representatives based on location.

Shrinkage and Lost Inventory

It is no surprise that hundreds of thousands of products go missing each year in the field. Medical device companies are more susceptible to increased inventory shrinkage due to the lack of item-level traceability paired with poor visibility of product once it has left a manufacturing or distribution center.

Increased Labor Costs

As more inventory is in the field, more time is spent managing that product. Oftentimes customer service or sales representatives spend countless hours trying to track down inventory or setting up shipments of product. Work is frequently duplicated due to human error found in manual workflows.

Compliance to Growing Regulations

Regulatory compliance demands are dramatically increasing. As product volume grows, so do the regulations. Unique Device Identification (UDI), FDA, and Joint Commission are tightening protocols and requiring medical device companies to take better control of their inventory. These increasing regulations not only apply to hospital or warehouse-based inventory, but to product in-field as well. Limited access to field inventory location and condition prohibits medical device companies from meeting compliance standards, resulting in increased fees, failed audits, and inability to comply with industry regulations.

Consignment Reconciliation

When inventory does not reconcile, it can create a difficult conversation between a manufacturer or distributor and the healthcare provider. This leads to poor customer relationships, lost sales, inaccurate charges, and extended negotiations. Automating

this process allows manufacturers or distributors immediate access to all inventory transactions and ensures that hospitals and providers are billed correctly.

Poor Demand Forecasting

Without real-time visibility, medical device companies are unable to see what product has been consumed. Ordering replenishment stock becomes tedious

and often inaccurate while waiting for updated reconciliations from the field. Plus this data is often over- or under-estimated due to limited knowledge of field inventory. This leads to a nearly impossible task for staff ordering inventory on a regular basis.

What is Driving the Need for Change?

Medical device manufacturers and healthcare providers alike are in the midst of a significant transformation, driven by financial, societal, and industry forces. The automated management of this incomprehensible amount of inventory is becoming increasingly necessary to overall operational efficiencies and the quality of customer and patient outcomes. The evidence points to a great need for a complete switch in how medical inventory is managed, simply based on the driving factors.

Cost

It is no secret that medical devices cost a substantial amount of money. With innovation and the rapid advancement of technologies, medical devices are currently one of the fastest growing industries, yet the process for tracking and managing this increasing sector is lagging. In addition, the healthcare industry continues to face significant cost pressure and outrageous spending. The amount of inventory sitting in the field between manufacturer and end user is mounting, and unawareness of the condition or location of a crucial $5,000 medical device or implant is costly in more ways than one. This threatens patient care, runs the risk of unavailable inventory during critical medical procedures, jeopardizes noncompliance, and hurts the relationship between a sales representative and the customer.

A quick inspection of the receiving room at many healthcare facilities proves the point. Many manufacturers rely on overnight service providers to afford next-day delivery for these critical parts. Yet, it is not uncommon for unopened overnight packages to be stowed in a storage room for long periods of time. Plus, many customers on consigned inventory status sign contracts that hold them responsible if product disappears. This can potentially lead to an uncomfortable conversation when issuing a customer bill for the loss of an expensive medical device. Many medical device manufacturers choose to absorb the cost of missing product, rather than create straining issues with their customers. Although estimates vary, medical device manufacturers write-off between one to four percent of inventory annually. A simple look at the math shows how quickly that adds up.

Because the margins for products like prosthetics, orthopedic supplies, and cardiothoracic implants are so high, key stakeholders often overlook the problem of missing, expired, or lost inventory instead of deploying solutions that can save the industry billions, while dramatically increasing patient care.

Compliance Standards

Given the vital importance that medical devices play in human life, and a history of large and expensive recalls, there is growing interest from government regulators to fully document chain of custody for medical devices. There are numerous product handoffs from the time a product leaves the manufacturing facility to when it is implanted in a patient at a healthcare facility. Quite often, the chain of custody is non-existent between the manufacturer and distribution center, to distributors, field sales representatives, and the hospital or clinic. Some medical device manufacturers have 12 months or more of inventory in the field that cannot be accounted for, placing the company and investors at a high degree of risk.

For publicly traded companies, which must contend with Sarbanes-Oxley and other accounting regulations, automating the way in which inventory is managed throughout the value chain can mitigate that risk at a low cost.

In addition, the pending Unique Device Identification (UDI) regulations mandated by the U.S. Food & Drug Administration has required that all implantable devices be labeled with a unique identifier and a production identifier, which has a lot number or serial number and expiration date. UDI regulation is expected to improve medical device reporting by providing a standardized, reliable, and unique identifier with which to report a problem device. This will expectantly lead to reduced negative patient incidences and will make recalls painless.

Labor Savings & Efficiencies

This aspect of the medical device industry has challenged device manufacturers and healthcare providers for decades. A report from the Bureau of Labor Statistics shows that unit labor costs in pharmaceuticals and medicines rose 3.7% per year from 1987 to 2018, and 2.4% from 2017 to 2018 alone. Because of gaping inefficiencies and mounting costs throughout the entire supply chain, manufacturers and healthcare providers waste billions of dollars each year due to lost products, expiration issues, and products that are used in procedures but are never billed.

When a supply kit carrying medical devices leaves a distribution center or manufacturing facility, it can contain hundreds of thousands of dollars’ worth of critical supplies. Yet, when the kit leaves and enters the field, the manufacturer loses all traceability around the devices. As a result, the manufacturer has no knowledge of the contents’ location or condition. There are not many industries that operate in this fashion, yet the medical device and healthcare fields continue to deploy manual processes that require excessive amounts of staff time and can easily lead to human error. Without the ability to access product status as needed in real-time, the increasing risks associated with abundant field inventory will only worsen. A study done by Emergo Group, a consulting firm for the medical device industry, revealed that pricing pressure is a big concern for these companies. Among companies with 250 or more employees, 61% said pricing pressure was amongst the biggest challenges.

Our Vision for a Smart Inventory Management System

The current solution for managing field inventory is manual and reactive. This leads to unbalanced resources, unnecessary operational costs, and an unsatisfactory patient and staff experience. Yet, with the rapid growth of IoT and RFID technologies, there is no reason why a feasible solution cannot be applied to the healthcare medical device markets. Medical device manufacturers continue to search for ways to reform their processes. In a 2016 survey, 78% of medical device companies said that they wanted to reduce costs while 66% said they were working on value-based purchasing. Both of which can be met with a real-time, automated solution.

As we begin to see a paradigm shift in the way in which healthcare is conducted, it is time to start adopting a new way of managing and tracking critical assets. The industry is moving toward a value-based delivery model that seeks to improve care quality while lowering costs. This model depends heavily upon digitalization and access to better and more timely information.

If a retail manufacturer can gain value by RFID tagging all of the shirts that are shipped to a large department store, the value that medical device manufacturers can derive from tagging high-value products like heart valves and implantable devices is likely tenfold. This turns the current medical device inventory management landscape from a highly reactive system to one that is proactive, sensing the need for change before it is too late.

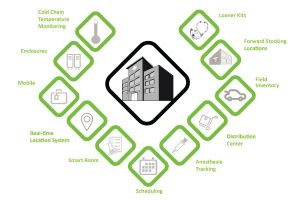

Healthcare providers and suppliers are becoming enablers of progress and streamlined healthcare. A model that possesses sophisticated situational awareness and operational intelligence. Gartner refers to this next-generation healthcare delivery model as the “real-time healthcare system” (RTHS). A real-time system eliminates waste and latency inherent in many manual processes while working to improve care quality, business operations, and the patient experience by increasing situational awareness and operational intelligence. The concept of the real-time healthcare system is the ticket to creating a smart inventory management system. At Terso, we have boiled down the very broad framework of a real-time healthcare system and created a vision for a fully connected healthcare organization that can be adopted by every sector of the healthcare industry.

A Smart Inventory Management System connects every asset within a healthcare organization. This provides visibility to each patient, clinician, care provider, room, medical supply, medication, and chemical as well as their location and condition.

For example, the location of a heart valve, expiring products in inventory, or where a wheelchair was last placed can be determined in seconds. Using the context of a real-time healthcare system, a smart inventory management system uses interconnected intelligent systems to make managing inventory seamless. Creating a smarter, proactive health system that can be easily shared and accessed in real-time by anyone, anywhere.

Figure 1: Smart Inventory Management System

Figure 1: Smart Inventory Management System

The RFID Mobile Case for Automating Field Inventory Management

The good news is that the medical device and healthcare industry is beginning to adopt real-time technologies and solutions as we speak. Medical device companies are beginning to see the advantages of adopting RFID mobile solutions to better manage inventory once it leaves the manufacturing facility or distribution center.

Terso Solutions has developed the RAIN RFID-enabled Mobile Case to provide an automated solution for managing high-value inventory in the field. The Terso Mobile Case is equipped with a powerful RAIN RFID reader coupled to multiple antennae that reach every piece of inventory placed in the case. Each product requires a RAIN RFID tag, most of which are affixed to the product at a distribution center before being placed in a field representative’s inventory case. Once in the RFID-enabled Mobile Case, all tagged products become visible in real-time through location-sensing technology and Terso’s cloud-based platform Jetstream®. By using this secure cloud-based tool, stakeholders across the entire supply chain – including suppliers, distributors and healthcare providers – can leverage the data by integrating it into an ERP software inventory management application, EHS, or BI system.

The Mobile Case also includes location-sensing technology that tracks the physical location of each case in real-time. After an item is consumed or removed from the Mobile Case, RFID technology automatically determines any inventory changes and makes the data immediately available. This allows the manufacturer the option of sending just the items to be replenished to that case, immediately invoicing and automating the replenishment cycle, or requesting the case be returned for full restock. This also means that the Mobile Case gives visibility of expiration data and lot tracking information, showing what products were used at what location. Automated inventory reporting eliminates shipping costs associated with sending consignment cases back for manual inventory replenishment and simplifies rep-to-rep transfers, enabling in-field replenishment. With impending regulations like the UDI rule and strict Joint Commission Standards the mobile case meets policy compliance and helps better manage recalls. With the data provided, the applications that can be run are extensive, providing valuable demand-driven data back to the manufacturer.

An RFID-enabled solution such as the Mobile Case presents yet another opportunity for the medical device industry to achieve compliance, maintain safety, and mitigate high costs. As with any device that connects to the Internet, the RFID-enabled Mobile Case becomes an extension of the medical device company and its customers. This becomes more about possessing the right information and inventory at the right time, while having the means to use that data effectively – saving money, time, and increasing the outcome your product has with the end user. This will optimize the management and execution of the most critical assets and workflows, and all while providing real-time data that is critical to your business and the end-user.

Figure 2: RFID Mobile Case

About Terso Solutions

Terso Solutions, Inc. is the leading provider of automated inventory management solutions for tracking high-value medical and scientific products in healthcare and life science. Terso Solutions, Inc. is backed by 15 years of RFID product development and implementation experience. Our product line includes RAIN RFID cabinets, refrigerators, freezers (-20C to -80C), read points, mobile solutions, and secutiry cabinets. Terso has deployed over 3,500 RAIN RFID-enabled devices worldwide. Headquartered in Madison, WI, Terso Solutions is a wholly-owned subsidiary of the Promega Corporation. Additional information is available at www.tersosolutions.com.