Introduction

While many medical device companies still use traditional, time intensive manual management techniques for surgical loaner kits, those who embrace automated technologies will be able to fulfill a critical technological link between the manufacturer, hospital, and the sales representative.

Health care facilities often take on surgical cases which require expensive specialized instruments that extend beyond their standard equipment stock. Loaner kits have been developed to alleviate this potential point of financial strain. Medical device manufacturers collaborate with hospitals to compile necessary components for specific cases at a more pragmatic price than the facility privately investing in the device.

The current model of loaner kit use and distribution requires manual engagement from manufacturers, sales representatives, and hospital central supply at minimum. Traditional workflow can follow one of three trajectories.

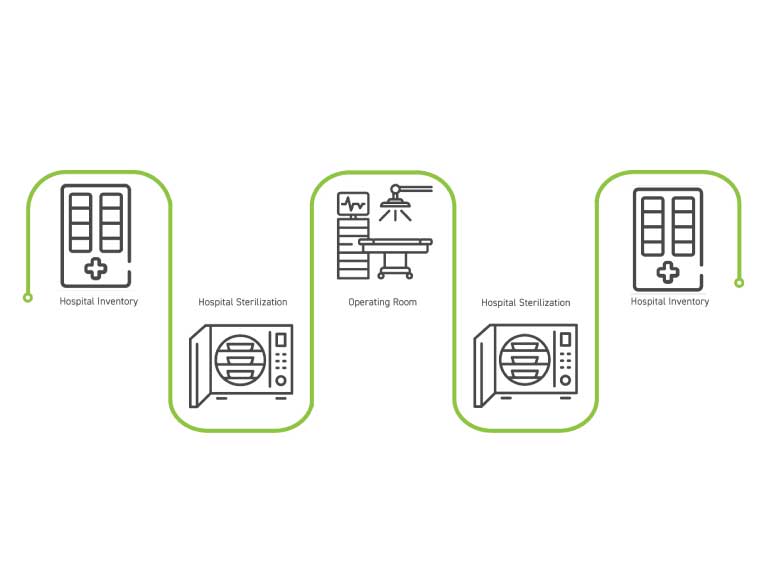

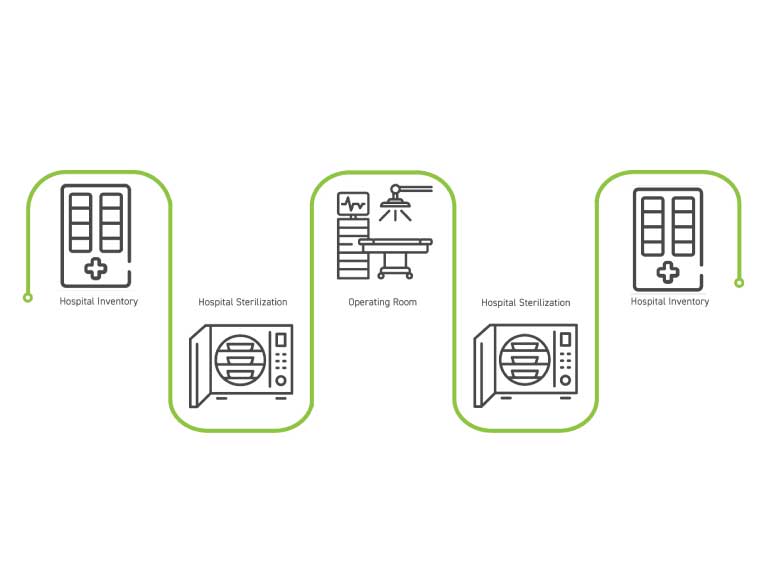

Permanently consigned kits reside full time in one high-volume hospital account and loop between hospital shelf, sterile processing, the operating room, back to sterile processing, and back to the shelf to wait for the next surgery, as modeled in the workflow to the right.

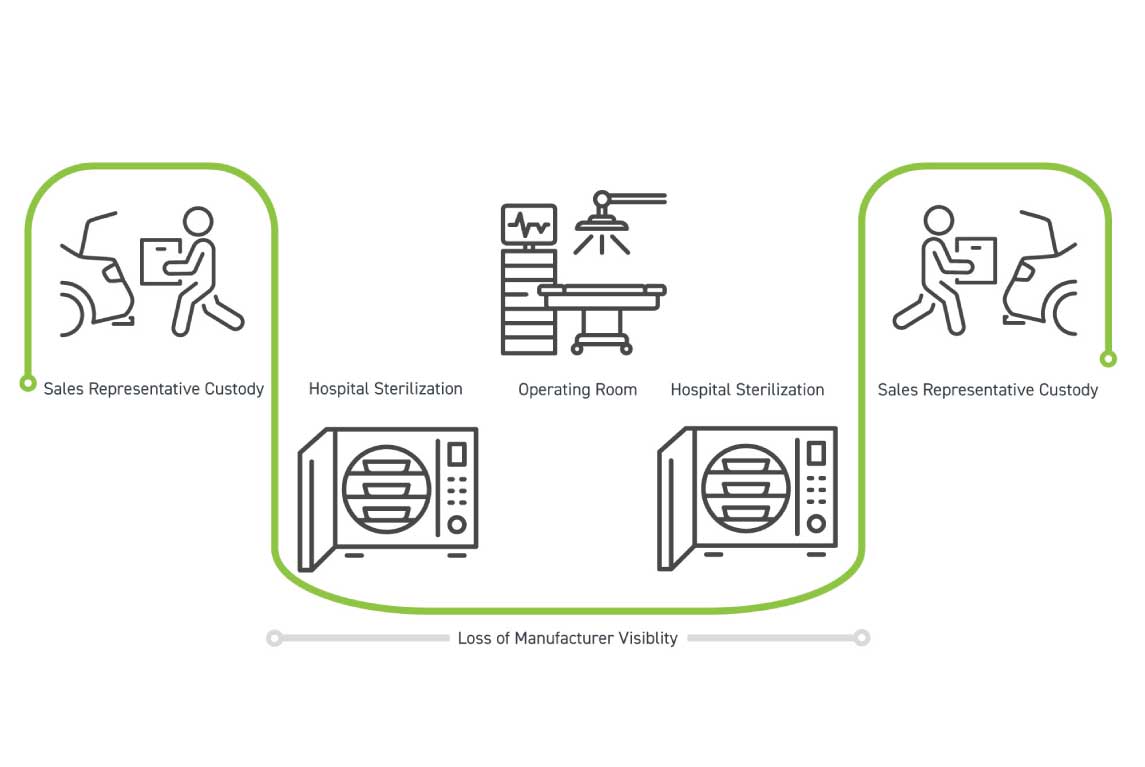

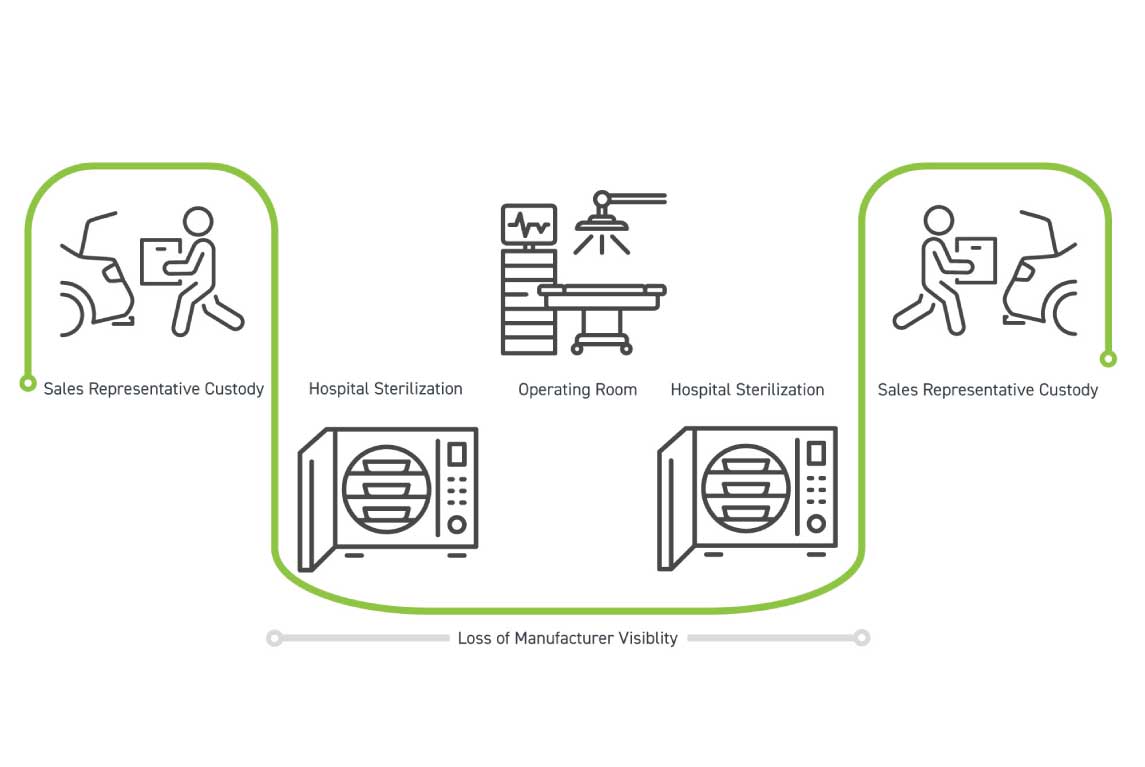

The second workflow is known as trunk stock and these kits primarily reside with sales representatives until a case is scheduled. The image to the left demonstrates kits transition from sales representative custody to hospital sterile processing, where the hospital takes over responsibility for sterilization, delivery to the operating room, and kit re-sterilization. At this point, the manufacturer and sales representative lose visibility of the kit until the representative picks it up to store for future use.

National Loaner Kits

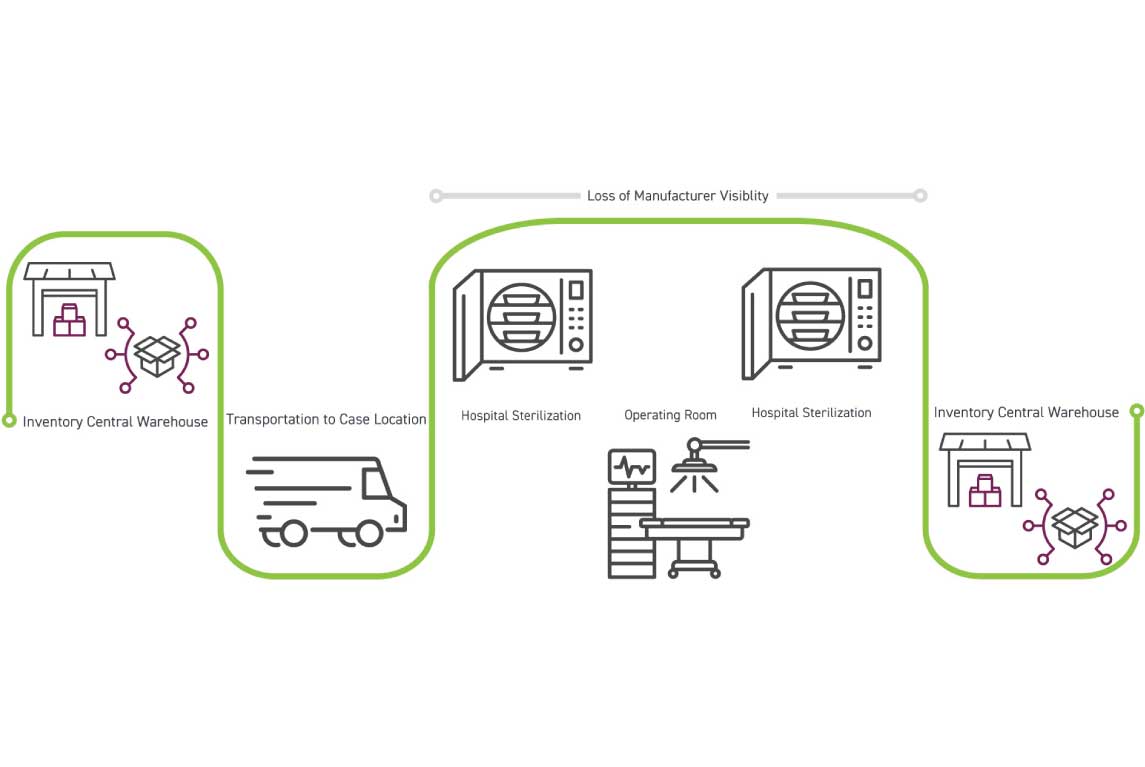

National loaner kits reside in a central location and are shipped to the sales representative or hospital for an upcoming case. After shipment, the manufacturer loses visibility once the kit moves into the hospital and only gains insights on tool usage after the set has returned to the national loaner center for cleaning, inspection, and restocking. The set is held at the national center until needed for the next request, as illustrated in image below. The ongoing challenge is limited kit visibility throughout transport and use. Once a kit returns, it requires a manual check in before customer service regains visibility of the kit. The kit does not get reprocessed until this check in, potentially resulting in shipping delays, lost revenue opportunities, and over stocking of inventory.

Keith Hoffman, Director of US Sales at Terso Solutions, explains successful medical device manufacturers put “a big focus on reduced costs and efficient operation,” and recommends all companies “investigate any opportunity to make improvements and remain competitive” in the industry. Hoffman recognizes the lack of real-time visibility as a financial burden for manufacturers.

This current model has continued for a while with manufacturers absorbing costs related to inefficiencies, such as kits being out of commission for inspection and replenishment, to ensure surgeons use their devices, rather than those of a competitor. The current transport model has proven to be sufficient and has solidified loaner kit necessity in approximately 20% of all surgeries (BioSpace).

However, this loaner kit process is not a fiscally responsible option for manufacturers to achieve optimal time and cost efficiency. With manual inventory monitoring, the average sales representative is spending 20% of their work week engaging in administration and inventory control rather than facilitating sales or collaborating with physicians. In this time, sales representatives are also losing potential opportunity to support larger territories or achieve higher quotas.

Additionally, loaner kits are rarely readily located, so most manufacturers invest in 2x the inventory required to support nationwide sales. Jerry Brown, Vice President of Operations and Chief Technology Officer at JR Healthcare Solutions, clarifies “manufacturers could support their current sales with 50% less inventory if there was a good mechanism in place for tracking kits.”

Current reliance on manual inventory management consistently results in inventory over-investment, untracked expiration, and supply shortages. Jonathan Tillman, Chief Executive Officer at Medical Tracking Solutions, observes to remain competitive in the industry, companies do not have an option other than adopting efficient processes so they can “reduce the cost of capital tied to inventory and improve their representatives experience.”

RFID loaner kit tracking solutions aim to alleviate these pain points in current manufacturer inventory management. Real time visibility processes are end-to-end solutions connecting manufacturer to hospital and support a streamlined process without compromising quality of care.

Automated inventory management through RFID tracking solutions eliminates the need for manual data entry or bar-code scanning. The system also helps resolve lost revenues by tracking exact cost per case and can alert for specific items that are expiring soon.

In tandem with RFID tracking supporting visibility in the field, it also serves as a vital tool for hospitals and manufacturers to ensure availability of necessary tools prior to a case. Brown elaborated on this link through explaining that hospitals cancel 2-3% of surgeries due to lost inventory. Studies confirm RFID as an effective solution for hospital inventory loss, with surgical time delay rates decreasing from 4% with manual systems to 1% with RFID (Seckman).

Medical device companies that are embracing the new technologies and leveraging them to improve performance can price more aggressively and in turn take market share. “It really is a simple solution,” states Tillman, “use less inventory per sale, save money, reduce price, increase sales.” But how are common hesitancies, such as cost investment and integration into the sales representative role alleviated through RFID?

RFID ROI- An Investment Proven To Pay

A main hesitancy for automated inventory adoption is cost of implementation. RFID solutions for loaner kit tracking can be costly investments for manufacturers; however, the return on investment for RFID solutions can be seen shortly after implementation in financial, inventory, and time savings.

Without real-time visibility, companies are led to purchase more inventory than necessary to sustain all potential cases around the country. With an automated inventory process, manufacturers can maintain real-time visibility of their loaner kits which gives them confidence to move inventory across the nation. This confidence allows them to invest in fewer physical assets and optimize inventory they already have. Brown explains “top orthopedic companies are already saving 30-40% of inventory,” with RFID solutions. Medical device companies are currently in custody of 25-50% more inventory than they need to successfully serve their customers. Eliminating excess inventory in the field enables quicker turn over which could decrease company spending significantly. Comprehensive automated inventory management software provides top management with the visibility and insights required for them to make informed decisions on future inventory investment based on factual, real-time inventory data.

Return on investments can most clearly be seen through observing cardiac catheter labs. These exhibit a successful adoption of RFID inventory tracking allowing them to optimize their assets. A time saving distinction can be observed when comparing multiple hour-long manual inventory checks that catheter labs perform compared to those with RFID systems, which can send the manufacturer accurate inventory counts in seconds (Fornell). RFID solutions bridge the gap between healthcare facilities and manufacturers by providing an effective solution for cost control and elimination of non-efficient stocking (Tierney).

More broadly, Advocate Good Shepherd Hospital in Illinois automated inventory management with RFID technology and observed their annual inventory losses decreasing by about 10 percent (Coustasse). It is essential for manufacturers and hospitals to effectively collaborate through inventory optimization so clinical resources are used to provide effective patient care rather than supply management.

Seamless Sales Rep Integration

In the current medical device landscape, sales representatives achieve high sales and build rapport with healthcare facilities through their dedication to obtaining correct devices for their cases in a time effective manner. Many manufacturers are hesitant to adopt inventory processes that could interfere with their sales representative success and consequently neglect the potential benefit of integrating an automated tracking system, which would supplement sales representative accomplishment and work efficiency.

Medical device sales representatives in the current loaner device models spend at least seven to ten hours a week transporting and obtaining their inventory. More specifically, they spend significant portions of their work week locating inventory, calling colleagues to track down necessary kits, and filling out forms. In contrast, RFID solutions could provide product visibility throughout transport checkpoints, allowing for real-time feedback on supply and product expiry, as well as streamline the billing processes.

Monetizing time savings associated with representatives prioritizing sales and collaboration in operating rooms rather than managing device inventory has proven to be difficult as time savings is hard to achieve in the current landscape. As sales representatives decrease their time invested in locating inventory and paperwork, they can proportionately increase hours spent productively engaging in sales.

The hesitance to disrupt sales representative’s workflow is a logical one, as they are essential to ensuring cases run smoothly. The sales representatives attend most cases and often will rely on trunk supply when extra parts are needed. However, this is not the optimal solution for manufactures who lose sight of inventory being stored outside of their facility nor representatives and doctors who will have to pause their case to track down necessary devices.

A key element of real-time visibility is the ability to enhance the sales representative’s efficiency and confidence in knowing their loaner kits will be fully stocked and ready for the case upon arrival at the facility. Brown explained, “the basic dilemma for everybody is if I need a certain device, do I know exactly where I can find one without spending a lot of time tracking it down?” Sales representatives willingly dedicate hours to avoiding potential problems in the operating room, but if the whole company knew locations of all their assets, corporate assistance would be able to aid in tracking down difficult-to-find parts.

There is plenty of inventory in companies’ possession, but it is often in the wrong places. Through real-time visibility technology, companies are equipped with tools they need

Terso Solutions, Inc. is the leading provider of automated inventory management solutions for tracking high-value medical and scientific products in healthcare and life science.